All Categories

Featured

Table of Contents

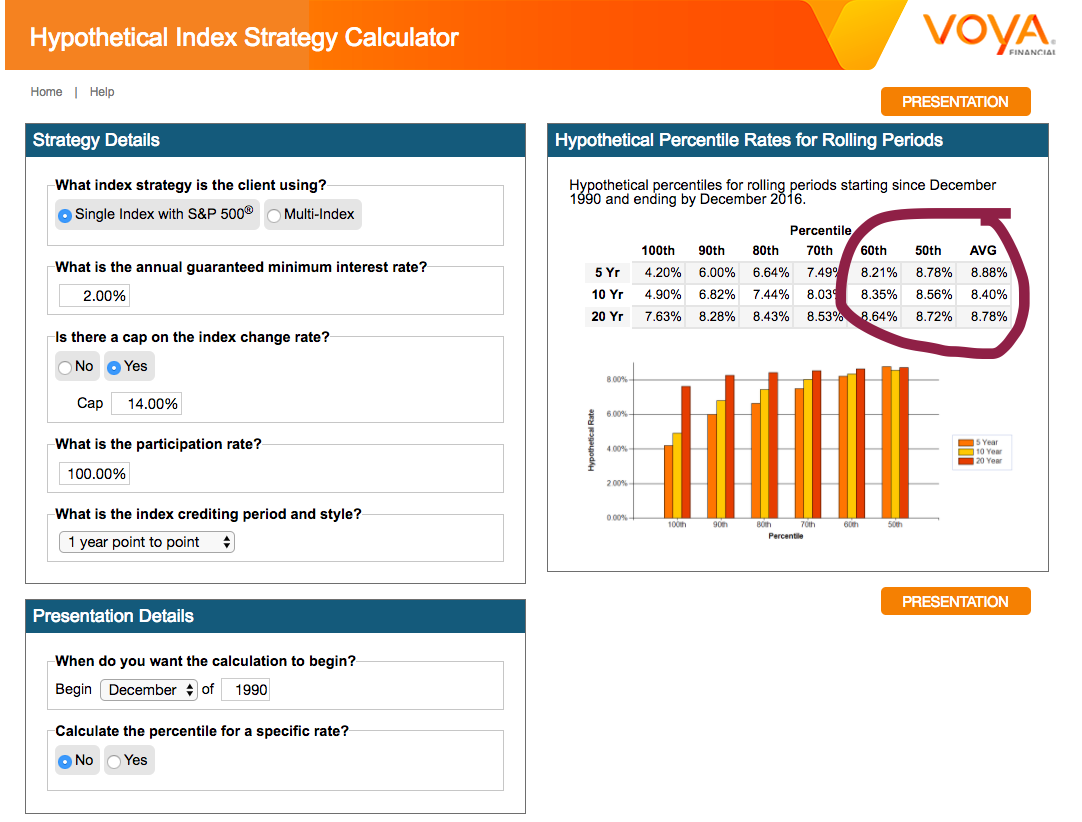

Getting rid of representative compensation on indexed annuities enables significantly higher illustrated and real cap rates (though still considerably lower than the cap rates for IUL plans), and no question a no-commission IUL plan would certainly push illustrated and actual cap rates higher also. As an aside, it is still possible to have a contract that is really rich in representative compensation have high early cash surrender values.

I will certainly yield that it goes to least in theory feasible that there is an IUL plan out there issued 15 or twenty years ago that has supplied returns that are exceptional to WL or UL returns (a lot more on this listed below), yet it's essential to much better recognize what a proper comparison would certainly entail.

These policies typically have one bar that can be evaluated the business's discretion annually either there is a cap rate that defines the optimum attributing price in that specific year or there is an involvement rate that specifies what percent of any type of favorable gain in the index will be passed along to the policy because certain year.

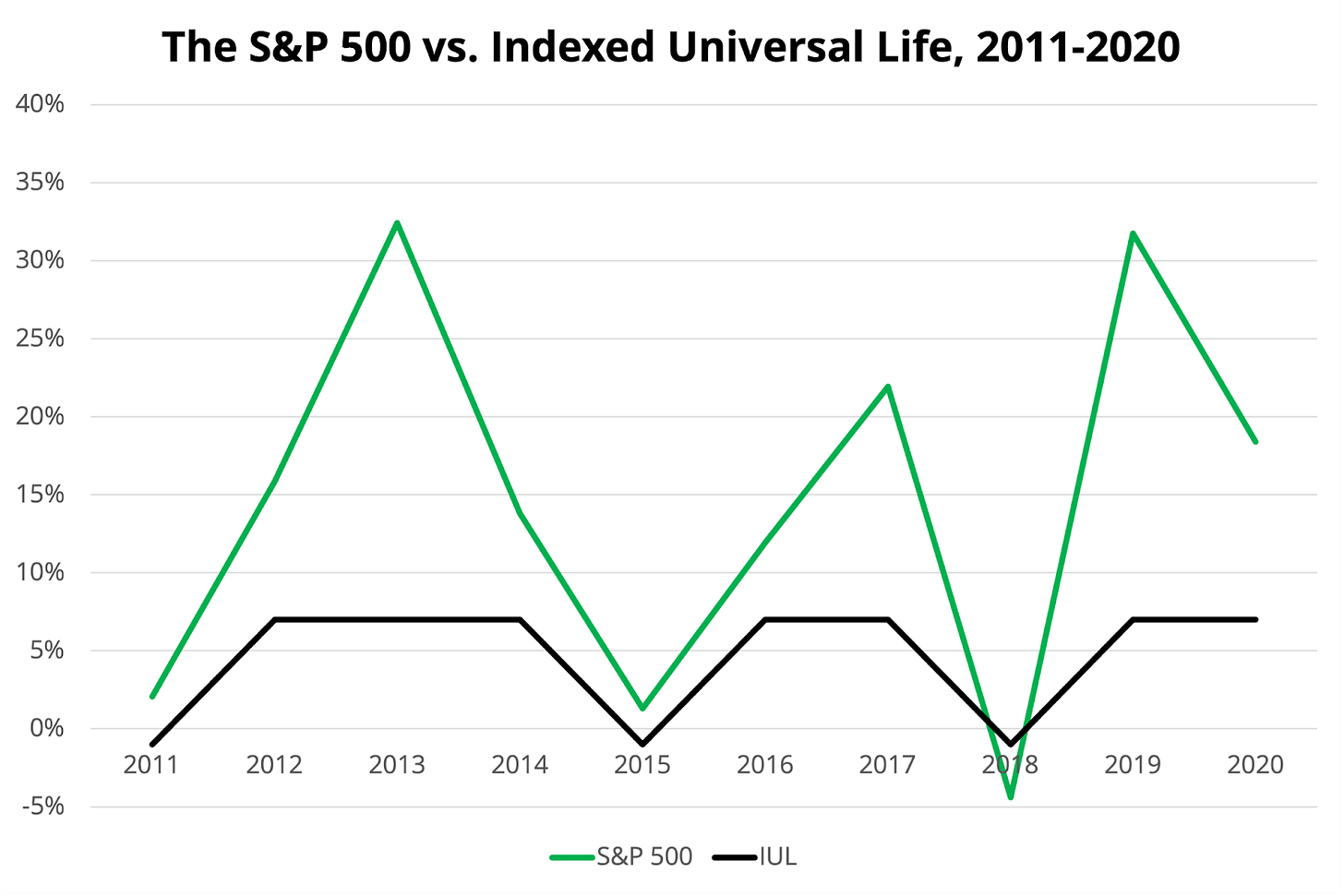

And while I typically agree with that characterization based upon the mechanics of the plan, where I differ with IUL supporters is when they identify IUL as having superior go back to WL - fidelity iul. Lots of IUL supporters take it a step further and indicate "historical" information that seems to sustain their cases

Initially, there are IUL plans around that lug more risk, and based on risk/reward concepts, those policies must have higher anticipated and real returns. (Whether they in fact do is an issue for major debate however companies are utilizing this strategy to assist validate greater illustrated returns.) Some IUL policies "double down" on the hedging method and assess an added charge on the policy each year; this fee is after that utilized to enhance the alternatives budget plan; and after that in a year when there is a positive market return, the returns are enhanced.

Maximum Funded Indexed Universal Life

Consider this: It is feasible (and actually most likely) for an IUL plan that averages a credited price of say 6% over its very first 10 years to still have an overall adverse price of return throughout that time because of high costs. Numerous times, I find that representatives or customers that extol the performance of their IUL plans are perplexing the credited rate of return with a return that properly reflects every one of the plan bills too.

Next we have Manny's inquiry. He states, "My friend has been pressing me to buy index life insurance and to join her organization. It looks like a Multi level marketing.

Insurance coverage salespersons are not poor individuals. I used to sell insurance policy at the start of my occupation. When they offer a costs, it's not unusual for the insurance coverage firm to pay them 50%, 80%, even sometimes as high as 100% of your first-year premium.

It's difficult to offer because you got ta always be looking for the following sale and going to locate the following individual. It's going to be difficult to locate a lot of fulfillment in that.

Let's speak about equity index annuities. These things are preferred whenever the markets are in a volatile duration. You'll have abandonment periods, commonly seven, ten years, perhaps also beyond that.

What Is Iu L

Their abandonment durations are big. So, that's just how they know they can take your money and go totally invested, and it will certainly be fine because you can not return to your money up until, once you enjoy seven, ten years in the future. That's a long-term. No matter what volatility is taking place, they're possibly going to be great from an efficiency perspective.

There is no one-size-fits-all when it comes to life insurance./ wp-end-tag > In your busy life, financial self-reliance can appear like an impossible goal.

Less employers are offering typical pension strategies and many firms have actually decreased or ceased their retired life plans and your capacity to depend solely on social protection is in inquiry. Even if advantages haven't been decreased by the time you retire, social protection alone was never planned to be adequate to pay for the way of life you want and are entitled to.

Universal Guaranty Investment Company

Now, that might not be you. And it is very important to know that indexed universal life has a lot to supply individuals in their 40s, 50s and older ages, along with individuals that intend to retire early. We can craft a remedy that fits your certain situation. [video: An illustration of a man appears and his wife and child join them.

This is replaced by an illustration of a document that reads "IUL POLICY - $400,000". The document hovers along a dotted line passing $6,000 increments as it nears an illustrated bubble labeled "age 70".] Currently, expect this 35-year-old man needs life insurance policy to safeguard his household and a means to supplement his retired life earnings. By age 90, he'll have gotten nearly$900,000 in tax-free earnings. [video: Text boxes appear that read "$400,000 or more of protection" and "tax-free income through policy loans and withdrawals".] And ought to he pass away around this time around, he'll leave his survivors with greater than$400,000 in tax-free life insurance policy benefits.< map wp-tag-video: Text boxes appear that read"$400,000 or more of protection"and "tax-free revenue via plan lendings and withdrawals"./ wp-end-tag > As a matter of fact, throughout all of the accumulation and disbursement years, he'll obtain:$400,000 or more of protection for his heirsAnd the chance to take tax-free revenue with policy car loans and withdrawals You're probably asking yourself: Exactly how is this feasible? And the answer is straightforward. Interest is tied to the performance of an index in the securities market, like the S&P 500. The money is not directly spent in the stock market. Interest is attributed on an annual point-to-point sectors. It can give you much more control, adaptability, and choices for your economic future. Like many individuals today, you may have access to a 401(k) or other retired life plan. And that's a fantastic initial step in the direction of saving for your future. It's important to understand there are restrictions with certified strategies, like 401(k)s.

And there are restrictions on limitations you can access your money without penalties. [video: Text boxes appear that read "limits on contributions", "restrictions when accessing money", and "money can be taxable".] And when you do take cash out of a certified plan, the cash can be taxed to you as earnings. There's an excellent factor so numerous people are transforming to this unique remedy to fix their monetary goals. And you owe it to on your own to see exactly how this could function for your own personal situation. As component of a sound monetary strategy, an indexed global life insurance coverage plan can help

Universal Life Insurance Premium Increases

you take on whatever the future brings. And it supplies unique possibility for you to construct significant cash worth you can use as added income when you retire. Your cash can grow tax obligation postponed via the years. And when the plan is developed properly, distributions and the death benefit won't be tired. [video: Text box appears that reads "contact your United of Omaha Life Insurance company agent/producer today".] It is necessary to seek advice from a specialist agent/producer that understands just how to structure a solution similar to this properly. Before dedicating to indexed global life insurance policy, right here are some benefits and drawbacks to take into consideration. If you pick a great indexed universal life insurance plan, you may see your cash money worth grow in worth. This is practical because you might be able to accessibility this cash prior to the strategy runs out.

Because indexed universal life insurance requires a certain degree of risk, insurance coverage business have a tendency to maintain 6. This kind of plan also supplies.

Typically, the insurance policy firm has a vested rate of interest in performing far better than the index11. These are all factors to be considered when selecting the ideal type of life insurance policy for you.

However, considering that this kind of plan is much more complicated and has a financial investment part, it can typically include higher costs than various other policies like entire life or term life insurance policy. If you do not assume indexed global life insurance is right for you, right here are some choices to think about: Term life insurance is a short-lived plan that normally uses protection for 10 to thirty years.

What Is The Difference Between Universal And Term Life Insurance

Indexed universal life insurance policy is a kind of plan that offers more control and adaptability, in addition to greater cash money value growth capacity. While we do not offer indexed universal life insurance policy, we can supply you with more info regarding entire and term life insurance coverage plans. We suggest exploring all your alternatives and chatting with an Aflac agent to find the finest fit for you and your household.

The rest is included in the cash money value of the plan after costs are deducted. The cash worth is credited on a month-to-month or annual basis with passion based upon rises in an equity index. While IUL insurance might verify important to some, it is necessary to understand just how it functions before acquiring a policy.

Table of Contents

Latest Posts

Iul Dortmund

Fidelity Iul

Term Insurance Vs Universal Life

More

Latest Posts

Iul Dortmund

Fidelity Iul

Term Insurance Vs Universal Life